Pensioners now have an easier time receiving pension-related information and updates through PRBS.PH, an online portal. Maintaining accurate and up-to-date personal information is essential for pensioners to guarantee a steady stream of payments. If pensioners want to improve their experience using the PRBS.PH portal, this post will show them how to do it step by step.

| Article Name | PRBS.PH Login Pensioner Update |

|---|---|

| Official Website | prbs.pnp.gov.ph |

| Login Link | Link |

| Phone Number | 0931-064-43-61 |

| pnp.prbs@gmail.com/prbspkskabroad@gmail.com |

Here are PRBS.PH Login Pensioner Update Steps

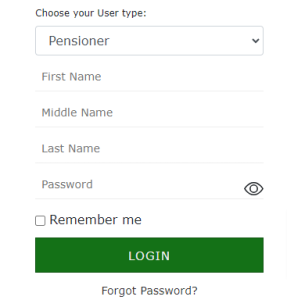

Step 1: Please go to the Login Page PRBS.PH.

Step 2: Enter Your Username/Email.

Step 3: Enter Your Password.

Step 4: Click on the “Login” Button: After putting in your username or email address and password, click “Login” to send the information.

LoginForgot Password

Step 1: Visit the login page of the portal .

Step 2: Click on the ‘Forgot Password’ link appearing on the login page screen.

Step 3: Now, Input your ‘Confirm Email Address’ in the fields.

Step 4: Press on the ‘Reset my password’ button.

Step 5: After that follow the steps which the website asks you to follow.

Benefits:

Smooth Benefits Processing: Keeping your details up-to-date ensures a seamless processing of pension benefits, minimizing delays or interruptions in payments.

Accurate Communication: Updated contact information guarantees that you receive timely and accurate communications from PRBS.PH, reducing the risk of missing important updates or notifications.

Secure Account Management: The verification process adds an extra layer of security, safeguarding your pensioner account from unauthorized access and potential fraud.

Efficient Fund Transfers: By updating bank details promptly, you ensure that pension funds are transferred to the correct account, avoiding any inconvenience related to payment discrepancies.

Compliance with Requirements: Uploading required documents during the update process helps you stay compliant with PRBS.PH regulations, ensuring your eligibility for pension benefits.

Transparency and Accountability: Regularly checking for updates on the portal keeps you informed about the status of your information, fostering transparency and accountability in the pensioner-benefit relationship.

Quick Issue Resolution: In case of any discrepancies or issues, a well-maintained and updated account facilitates faster resolution through the support channels provided by PRBS.PH.

User-Friendly Experience: Taking the initiative to update your information contributes to an overall positive and user-friendly experience on the PRBS.PH portal, enhancing the efficiency of the platform for both pensioners and administrators.

FAQ:

How do I log in to my PRBS.PH pensioner account?

Visit the official PRBS.PH website. Click on the login option. Enter your username and password to access your account.

Where can I find the “Update Information” section?

Once logged in, navigate to the dashboard or account management menu. Look for a section specifically labeled “Update Information” or something similar.

What is the verification process, and why is it necessary?

The verification process ensures the security of your account. It may involve answering security questions or using a one-time password sent to your registered mobile number or email.

What personal information can I update on PRBS.PH?

You can update contact information, address, emergency contacts, and other relevant personal details.

Also Read :

- MySmartice Login

- MyLabsNY WellNow com Login

- MyAlbertus Login

- MyAcadiaHealthcare.com Login

- KPUnet net Login

Conclusion:

Pensioners must update their personal information on PRBS.PH in order to get their benefits smoothly and without any problems. Pensioners can confidently access the portal by following these step-by-step recommendations, knowing that their information is accurate and up-to-date. This preventative measure improves the pension distribution system’s efficacy and efficiency while simultaneously improving the user experience. PRBS.PH is devoted to its users’ happiness and well-being, and that shows in its platform’s user-friendliness toward retirees.

For More info Check Loginguide.net